FIXED DEPOSIT AND INTEREST

With a time deposit as a term deposit, an investor leaves a certain amount to a financial institution for a predefined period of time. In return, the investor is compensated by the financial institution with an interest payment. The interest payment is made at the end of the term of the time deposit with the repayment of the transferred amount. In normal interest periods, the longer the term of the time deposit, the higher the interest rate will be. However, there may be exceptions to this rule, because fixed deposits and interest rates form a very complex subject area of the financial world.

But how is the interest rate of the fixed deposit determined?

Generally, the interest rate is determined by a contractual agreement between the bank and the investor. The interest rate is based on the market interest rates for the respective term. A market interest rate is created by supply and demand. These, in turn, are based on the central bank’s key interest rates, which determine the short-term interest rates for refinancing from the central bank and deposits of banks with the central bank. The prime rate thus determines the overnight deposit rate. For short-term time deposits with maturities of 1, 3 or 6 months, the interest rates thus deviate only slightly from the ECB’s key interest rate. The current key ECB interest rate for the so-called deposit facility relevant for fixed-term deposits has been -0.5% p.a. since September 2019. For the sake of comparability, interest rates are always stated per annum, which is indicated by the addition of “p.a.”.

Long-term comparison of fixed-term deposits and interest rates

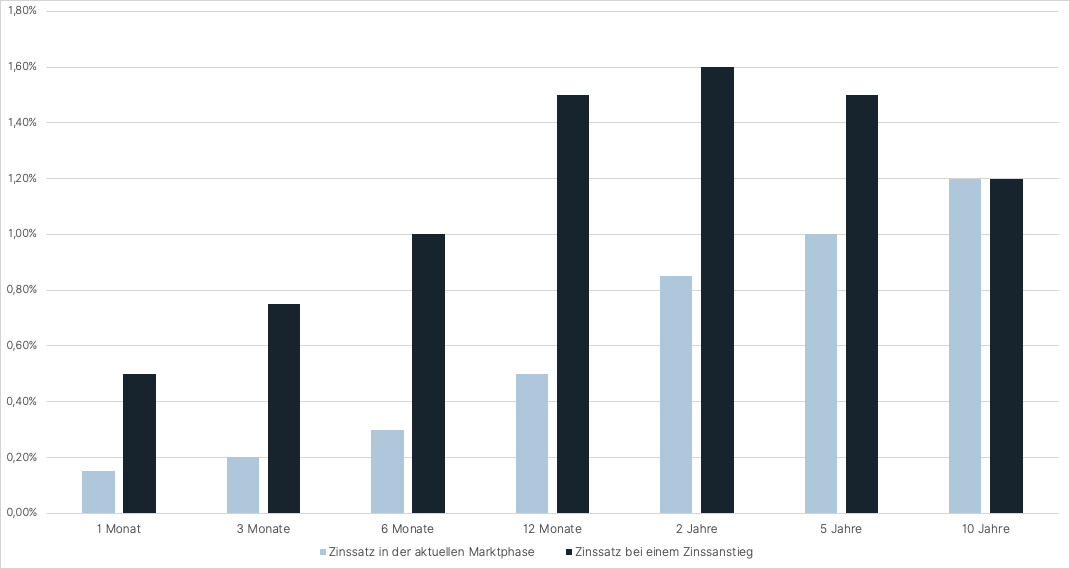

In the case of medium- and long-term interest rates, the deviations from the key interest rate tend to become larger, as these rates are mainly determined by supply and demand. Supply and demand, in turn, result from market participants’ expectations of interest rate changes in the future. The respective interest rates of the different maturities in relation to each other result in the so-called yield curve. An example of a time deposit yield curve in the current market phase is:

Time deposit with a term of:

1 month: 0.15% p.a.

3 months: 0.20% p.a.

6 months: 0.30% p.a.

12 months: 0.50% p.a.

2 years: 0.85% p.a.

5 years: 1.00% p.a.

10 years: 1.2% p.a.

The current yield curve for fixed-term deposits thus reflects market participants’ interest rate expectations that the current extremely low interest rate level should not change much in the foreseeable future. The curve is still slightly ascending but very flat. This can be seen from the fact that the interest rate is still very low even for longer-term time deposits and is hardly higher than for short-term time deposits.

If market participants were to expect a significant rise in interest rates in the future, then the supply and demand for fixed-term deposits would change. Short-term interest rates would rise and possibly even exceed the level of medium- and longer-term fixed deposit rates. The yield curve would become inverted. If interest rates rise, it will become increasingly unattractive to invest fixed-term deposits today with very low interest rates in the long term. This would make it all the more attractive to invest fixed-term deposits in the short term, because higher interest rates would be attracted by the next maturity of the fixed-term deposit. An example yield curve, if participants expect interest rates to rise, might look something like this:

Time deposit with a term of:

1 month: 0.50% p.a.

3 months: 0.75% p.a.

6 months: 1.00% p.a.

12 months: 1.50% p.a.

2 years: 1.6% p.a.

5 years: 1.5% p.a.

10 years: 1.2% p.a.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% p.a.

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

OUR ASSESSMENT OF FIXED-TERM DEPOSITS AND INTEREST RATES:

As can be seen from the previous example, fixed-term deposit rates are currently very low and even a moderate rise in interest rates would still not make fixed-term deposits look particularly attractive. This is mainly because an increase in interest rates is usually accompanied by or caused by higher inflation. And this is exactly the situation a time deposit investor is currently facing. Inflation threatens to rise to 4-5% this year in the euro area and the one-year fixed deposit pays 0.5% interest.

Inflation is therefore a multiple of the return on the time deposit, the interest payments on which also have to be taxed in most cases. That an investment loss with announcement and makes little sense! An experienced investment advisor of the asset manager Genève Invest will be happy to present you investment alternatives with more attractive interest rates and yields and will be pleased to talk to you. Click here to schedule a no-obligation consultation.