The pension calculator for private pension provision

On the Internet, numerous portals and magazines offer so-called pension calculators. These all serve to provide a relatively quick overview of what monthly pension payment a retiree can expect and when.

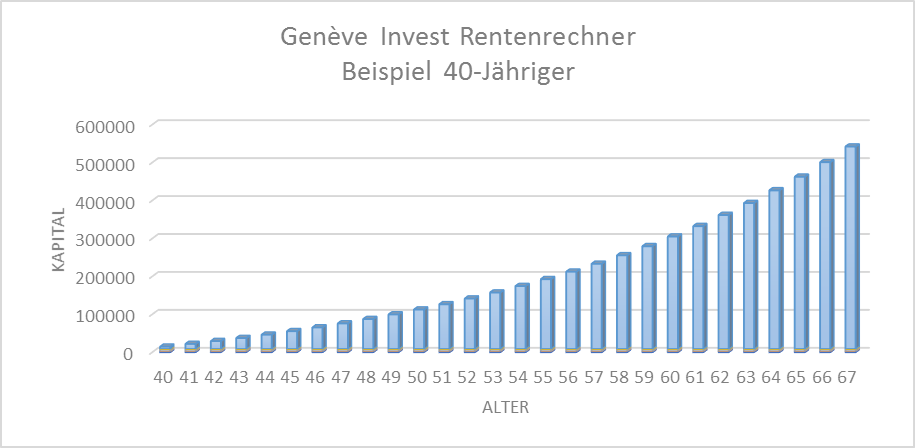

Such pension calculators can be found on the websites of the German Pension Insurance DRV, Handelsblatt, Focus, finanztip.de and numerous financial institutions. These calculators can be used to determine the monthly pension payment based on years of contributions and salary, or to show what pension sacrifice would have to be made in the event of early retirement. In almost every case, you will find that there is a pension gap. The pension gap describes the difference between the last net salary received and the pension payment. Increasingly, this pension gap is 50 percent or more. However, it is much more interesting to use the Genève Invest pension calculator to determine how a private pension plan can close this pension gap. And above all, to recognize the decisive influence of starting retirement planning as early as possible and letting the capital work for as long as possible. In the 1st calculation example of the Genève-Invest pension calculator, let's assume that a 40-year-old employee today decides to invest 500 euros per month in private pension provision from now on. And this is to be done with a share savings plan. It is reasonably realistic to assume that this equity savings plan will perform at 7% per year after expenses (the MSCI World has performed well over 10% per year over the last 20 years).

The pension gap describes the difference between the last net salary received and the pension payment. Increasingly, this pension gap is 50 percent or more.

The 40-year-old employee thus invests 6,000 euros per year over 27 years. The total investment is therefore 168,000 euros. And after 27 years with 7% performance and the underlying compound interest effect, this becomes an impressive 533,511 euros at the age of 67! And if at retirement age the retiree subsequently consumes only the capital appreciation, he will have EUR 37,345 annually or EUR 3,112 monthly at his disposal without reducing the capital! This would be more than close the pension gap. And that with "only" 500 euros of private pension provision per month.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

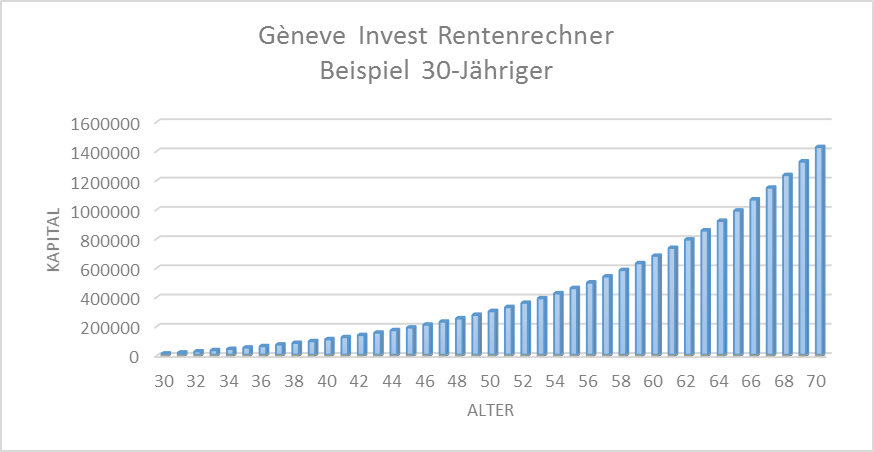

Let us now take a second example from the Genève Invest pension calculator: the same conditions as before, except that the employee is now 30 years old and has therefore started to make private provision 10 years earlier. So he has 37 years left and invests a total amount of 228,000 EUR. Then he will have EUR 1,141,303 at his disposal at the age of 67! In other words, more than twice the amount of the 40-year-old with the same savings rate of 500 euros per month. Accordingly, today's 30-year-old will have EUR 79,891 per year or EUR 6,658 per month at the age of 67. This retirement makes really easy to endure.

If the 30-year-old later decides to work 3 years longer and retire at 70, his retirement capital will already amount to EUR 1,419,507. If the 30-year-old were to halve his savings rate to EUR 250 per month, he would still have EUR 570,651 in capital available at 67.

READ MORE IN OUR FREE BROCHURE

The Geneve-Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have continuously held corporate bonds in our portfolio for more than 20 years and why this will not change in the future.

CONCLUSION

In conclusion, two eminently important findings can be drawn from these results of the Genève Invest pension calculator:

- You can't start making private provision early enough. The time factor is crucial.

- If you stick to this strategy continuously, you will have compound interest as a powerful, loyal ally at your side.