Bitcoin as an investment?

B

itcoin is now synonymous with a virtual currency, a so-called cryptocurrency. But what exactly is behind it? Is bitcoin suitable as an investment? Ultimately, a Bitcoin coin is nothing more than a numeric code. The code proves the right to a virtual coin or a part of it. The code can be used to make payments within a computer network, the Bitcoin network. They are legitimized within the network by the code. In the process, the virtual coins, bitcoins, change hands. The transaction is largely anonymous and does not require a central settlement agent.

To buy Bitcoins or exchange them back into real currencies, there are various exchange providers on the Internet. The exchange is possible relatively unproblematically for a more or less high fee. As a user, all you need is an appropriate program for your computer or cell phone. Bitcoin exchanges are not regulated and are not subject to government oversight. Virtually anyone who participates in the Bitcoin network can open their own exchange.

New Bitcoins are created by generating new code sequences using high computing power. This process is called mining. The total number of Bitcoins is limited by the base program to 21 million coins. Currently, more than 18 million coins are already in circulation.

How reliable is Bitcoin as an investment?

D

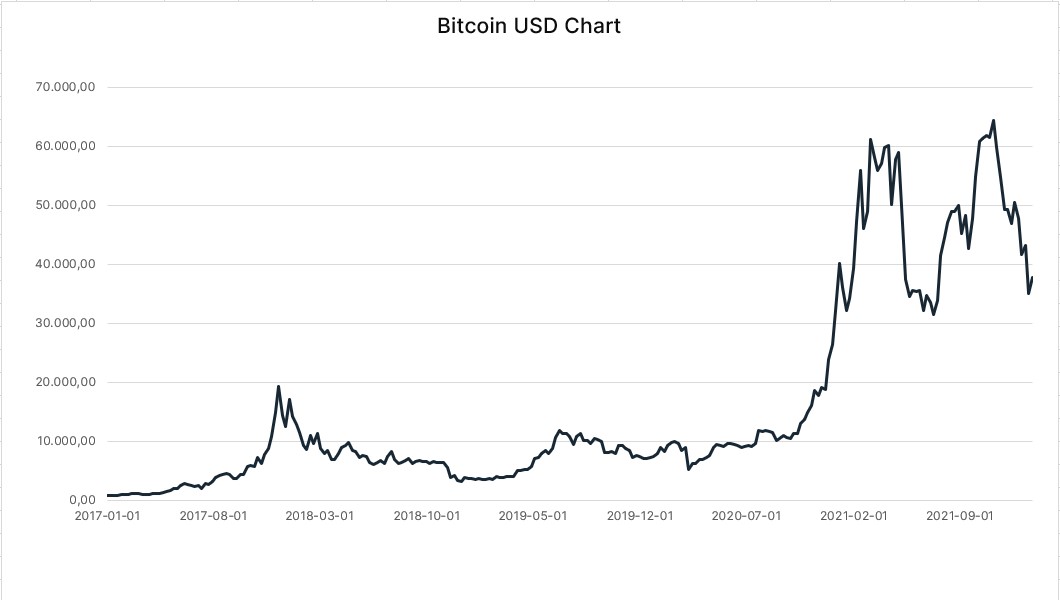

he bitcoin price (in U.S. dollars) reached an interim high of around $20,000 in December 2017 and then fell to around $3,500 in January 2019. At the end of 2020, a renewed flight to the top began, which then ended in a record high of almost USD 67,000 in November 2021. Since then, the price has fallen continuously to around USD 43,000 today. This price trend shows how much the bitcoin price fluctuates.

Bitcoins became increasingly interesting for many small investors, as they seemed to entice them with particularly high profits. But an investment also involves above-average risk. The price fluctuates widely, and even experts sometimes disagree on the reasons for the large swings. A single tweet from Tesla CEO Elon Musk can send the share price soaring – or bring it crashing down. Investors should be aware of this. Those who entered at the high of almost 67,000 USD have suffered bitter losses to date – if they had to sell.

A reliable financial investment, especially if it is to serve as a retirement provision, truly looks different. Bitcoin is not suitable for this purpose. A supplementary pension , on the other hand, offers investors the security they need in retirement.

Bitcoin and other cryptocurrencies should at most be considered as a speculative admixture in an overall portfolio context. And then really only in manageable quantities. So manageable that a possible total loss can be absorbed in any case.

In addition, people interested in Bitcoin should inform themselves in detail about how Bitcoin works. After all, it is not only the highly fluctuating price of bitcoin that poses risks. Regulatory efforts by individual countries and banking regulators may also influence the future price of bitcoin. Unlike the euro or the dollar, bitcoin is not backed by a central bank; no company, no government stands behind the cryptocurrency. It is also unclear who is responsible for overseeing the crypto exchanges where investors can buy bitcoins. This decentralized structure is what makes cryptocurrency so special, but it also entails risks for investors.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% p.a.

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

Our conclusion on Bitcoin as an investment

A

nvestors in Bitcoins basically only benefit from price increases when fresh money flows into the system. Bitcoin itself does not yield any return, neither interest nor dividends. The whole thing thus also has characteristics of a snowball principle.

A long-term sustainable investment, on the other hand, should always be based on business models that create value. Thus, the creation of added value should be recognizable.

For long-term investment, it seems more sensible to bet on a more modest performance in line with current capital market interest rates and the profit performance of commercial enterprises than on short-term gains from a speculative bubble.