Are US Bonds Worth a Closer Look? Answer: Yes!

It can definitely make sense for a European private investor to also invest in US bonds. In this way, you take advantage of several advantages: First of all, you can diversify the investments in this way and thus spread the risks better. In addition, the US economy and the European economy are often in different cycles, so an investment in US stocks can under certain circumstances cushion an economic downturn in Europe. The US bond market is the largest in the world. It therefore offers more choice than the European one and is also more liquid, which improves the tradability of US bonds. And the main reason that speaks for US bonds is that interest rates in the US are higher than in Europe.

The turning point in the US interest rate cycle is within our grasp - what measures is the ECB taking?

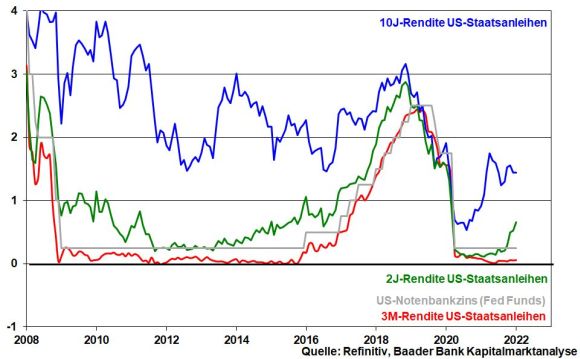

Due to the higher inflation (in January 2022 the rate of inflation in the USA had risen to 7%), US interest rates are around 2% higher than in Europe. The most important indicator of interest rates on the American capital market is the yield on the 10-year US government bond:

-

- Since its low of 0.5% in July 2020, it has risen steadily and is now just under 2%.

-

- The 10-year Bund has only just recovered to above zero.

But be careful: Always keep an eye on the exchange rate

Since US interest-bearing securities are quoted in US dollars, it is important to pay attention to the exchange rate development of the EUR/USD currency pair. Currently (03/10/2022) the exchange rate is 1.10. After the euro was still 1.22 in May 2021, it has lost significantly in value against the dollar in recent months. With the turnaround in interest rates in the USA beginning in March 2022, the US dollar should continue to have upside potential against the euro due to the even greater interest rate advantage. This makes US bonds even more attractive.

In the segment of US corporate bonds, the difference between euro bonds and US bonds becomes clear. While the bonds of large European companies are yielding as little as 2%, large US companies such as Xerox, Chemours, YUM! Brands or Altria returns of 5% and even a little over 6%.

Sample portfolio (interest calendar) – Genève Invest

The sample portfolio shows that attractive investment opportunities (both in EUR and USD) can be found. A real example portfolio (with a list of bond issuers) can be sent at any time on request

READ MORE IN OUR FREE BROCHURE

The Geneve Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have had corporate bonds in our portfolio for more than 20 years and why nothing will change in the future.