Green Bonds: Investing with a clear green conscience?

Investing in green assets and projects is part of the transition to a low-carbon economy. One important way of raising the necessary capital is to persuade public and private investors to buy green bonds, or so-called green bonds.

Above all, the EU would like to take the ESG criteria into account in this initiative:

- Umwelt (“Environment“),

- Social (“Social”)

- Responsible corporate management (“governance”)

The European Investment Bank (EIB) as a global pioneer of green bonds

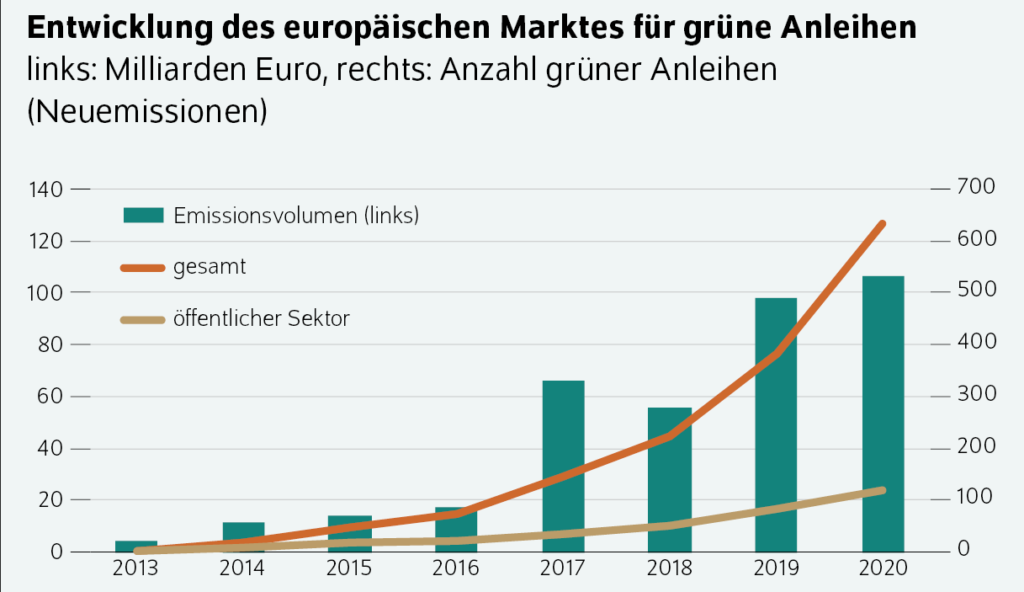

After the European Investment Bank (EIB) issued the first-ever green bond in 2007, the market grew slowly but then accelerated. In 2019 it already amounted to 258 billion US dollars. It is the fastest growing segment of the bond market today.

Development of the international green bond market

2007

First Green Bond (EIB, USD 823m)

2008

First green bond in a region (Nord-Pas-de-Calais, $74m)

2012

Total green bond volume reaches $3 billion

But what are green bonds?

Green bonds are a variety of impact investing. Green bonds are fixed income securities that offer issuers as well as investors the opportunity to support environmental and climate protection projects. Looking back at the short history of green bonds shows that when comparing regions, Europe was initially the pioneer. With 45 percent of the emissions, Europe is still the most important large region. The driving force of the EIB seems to play an important role here. However, if one differentiates by country, then in 2019 the USA, with an issuing volume of USD 51.3 billion, ranked well ahead of China with USD 31.3 billion and France with USD 30.1 billion.

Green bond issuers are often not that clean themselves!

Initially, the issuers of green bonds came from the state-related or from the purely state sector, which also included supranational or international organizations. From 2013, private companies also began to issue green bonds. The volume of private sector issuers has increased immensely since 2013, so that these "corporate green bonds" now account for a third of the entire market. These green corporate bonds are often issued by companies that are not originally from green sectors. The market is currently broken down as follows:

- Energy 34 %

- real estate 26%

- Transport 15-20 %

- water 10%

So everything just greenwashing?

In Germany in 2019, around 70% of the issue proceeds were invested in renewable energies and 25% in real estate. The main motives for issuing green bonds are the lower capital costs and reputation-enhancing sustainability signals in public. However, it cannot be ruled out that a deceptive sustainability facade will be built, the so-called "greenwashing". With regard to the lower cost of capital, companies hope to achieve a more positive credit rating through a better sustainability rating and thus obtain more favorable financing conditions. Or companies hope that investors will be willing to accept lower returns for the good cause. In both cases, the result would be a “Green Bond Premium” (also called “Greenium”).

READ MORE IN OUR FREE BROCHURE

The Geneve Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have had corporate bonds in our portfolio for more than 20 years and why nothing will change in the future.

Establishing standards for green bond issuance

It is considered essential for impact-oriented investing and thus for green bonds to ensure a high level of transparency of the investment goals and to achieve a earmarked use of the funds. After the publication of the "Green Bond Principles" (GBP) and later the "Climate Bond Standard" (CBS), issuing companies can now obtain a CBS seal. The initiative launched by the EU should also be based more comprehensively on the ESG goals and thus also on human rights.

Now is the ideal time to invest in bonds. Corporate bonds currently offer yields of over 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge and without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free advice & callback service

We are monitoring the development of the segment around green bonds very closely

Geneve Invest monitors the development of the green bond segment very closely and supports the establishment of a standard for setting sustainability goals and for checking the targeted use of funds from green bonds.

There is no question that bonds (especially institutional corporate bonds) belong in every well-diversified portfolio!

The corporate bond universe offers investors a comprehensive range of options to find the best combination of risk and return for them. Corporate bonds are therefore a core component of diversified, yield-oriented investment portfolios. In the current environment of low interest rates, it is practically impossible to meet the expectations of discerning investors with the traditional type of advice provided by banks and their mostly in-house products. Corporate bonds offer relevant reasons why they belong in every portfolio. Lower volatility compared to stocks and some degree of legal protection for bondholders mitigate risk. Furthermore, regular interest payments and repayments offer excellent predictability in order to optimally plan future liquidity needs.