High-yield corporate bonds

There are very good arguments for the asset class of high-yield bonds! In addition to public sector bonds, numerous companies also issue bonds. Corporate bonds and their various forms can behave completely differently from government bonds and other public sector bonds

A special segment of the bond asset class are high-yield bonds. There is no uniform definition or distinction between the high-yield segment and other bonds in the specialist literature. In the vast majority of cases, the high-yield bonds are corporate bonds. The rating of the issuing company is often used for differentiation, and all companies that do not have “investment grade” by one of the three major rating agencies Fitch, Standard & Poor or Moody's are considered high-yields. But that doesn't do it justice, because many smaller companies and niche players don't have a rating at all. Strictly speaking, the yield at maturity of the bonds should be used to make the distinction. In the current interest rate environment, it seems reasonable to classify a bond as high yield if the interest coupon is 5% or more. Because even a bond with an interest coupon of 3%, which is currently trading at a price of 90 two years before maturity, achieves a return of well over 5% and is therefore high-interest. Over the years, the high-yield bond market has attracted many investors seeking higher yields than government bonds or "regular" investment-grade corporate bonds. In recent years it has been possible to achieve a performance of 6-7% per year with high-yield bonds.

READ MORE IN OUR FREE BROCHURE

The Geneve Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have had corporate bonds in our portfolio for more than 20 years and why nothing will change in the future.

The credit quality in the high-yield segment has recently improved significantly!

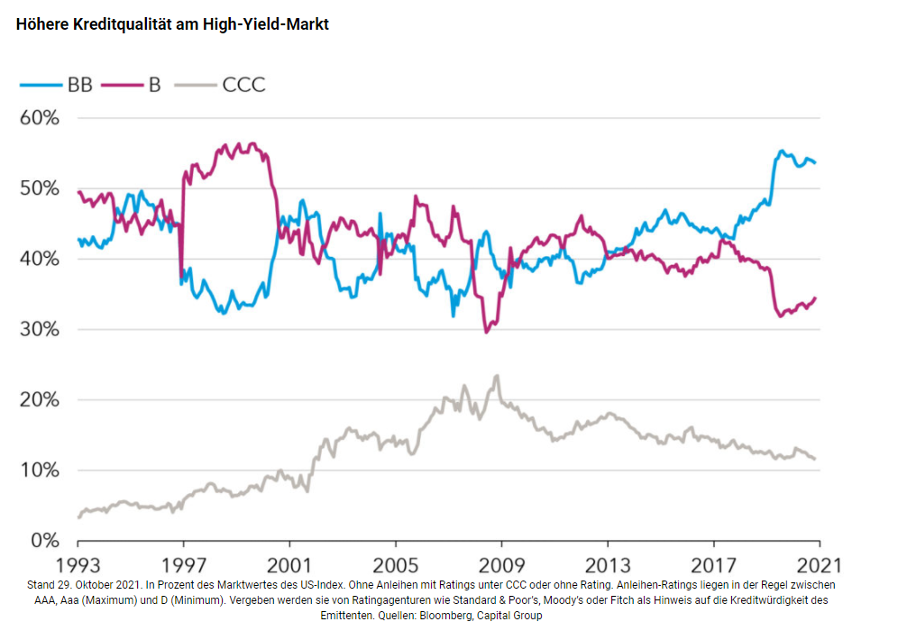

The average credit quality of the high-yield market – ie bonds with a maximum rating of BB/Ba – has improved significantly. There were many upgrades following the pandemic as the economy recovered. Because of the many "fallen angels" a number of titles with a BB rating were added. Today, BB-rated bonds, the highest high-yield rating, make up more than half of the market. The proportion of issuers with a CCC rating, on the other hand, has fallen from almost a quarter at the height of the 2008/2009 financial crisis to around 12 percent, almost the lowest level in 20 years.

The high-yield bond market offers some very interesting advantages for the investor!

We list some of these decisive advantages below:

- Lower fluctuations in value compared to shares

- Steady flow of income

- Access the benefits of diversification

- A degree of legal protection for bondholders

- Passive Income

An interesting calendar can help as a guide for passive income:

The sample portfolio shows that attractive investment opportunities can be found in this segment. A real example portfolio (with a list of bond issuers) can be sent at any time on request.

Attractive returns in a difficult low-interest environment!

In recent years, interest rates have steadily fallen in response to central bank policies. Finding a certain yield in the fixed income space is a challenge for both investors and asset managers. It's not uncommon to come across bonds with a negative yield. For example, German 10-year government bonds have a yield of -0.287% in 2021, which means that the value of the asset is declining year after year, both in nominal terms and in real terms, taking inflation into account.

Geneve Invest's contribution to diversification through high-yield bonds in a private investor's portfolio

Our task: Use opportunities in a targeted manner and find market niches!

Retail investors' needs haven't changed: They still need cash flow predictability, at least from one component of their portfolio, and that's understandable. We believe it's still possible to find attractive yields if you're willing to dig deeper; of course, this requires more effort, time, and resources than before. Often these are niche markets that are not easy for retail investors to tap into, and in some cases, they are too niche for large players such as high-profile funds. Our job is to take advantage of the opportunities that exist on the market. We analyze both the primary and secondary markets in-depth and find it particularly useful to speak regularly with those responsible to better understand each company's history and plans. This is also an advantage when assessing the actual risk because safety is the be-all and end-all, otherwise all guarantees are worthless.

It's all about the details! Healthy skepticism about ratings

We strive to balance risk by thoroughly analyzing and constantly monitoring each company. We look for seniority, payback rates, differential maturities in the portfolio, the impact of market volatility and the inherent protection that higher yields provide. We also pay attention to maturity to protect our clients' portfolios against inflation and potential interest rate increases. There is no question that selecting the right corporate bonds for your portfolio requires in-depth analysis and many years of experience. Genève Invest has proven expertise in the field of fixed-interest corporate bonds. Here, seven specific safety factors are decisive for sustainable success and the associated satisfaction of our customers.

We do not consider credit ratings to be a reliable indicator. While we take them into account, we rely on our own in-depth analysis using a model that we have developed and improved internally and that has been proven through various market cycles. As a result, over the past few years we have still managed to generate significantly positive returns for our investors, as evidenced by our audited performance results. The asset class of high-yield bonds has always played a major role here and has fulfilled its function well.