Inflation Linked Bonds - Why the Private Investor Needs to Act Now!

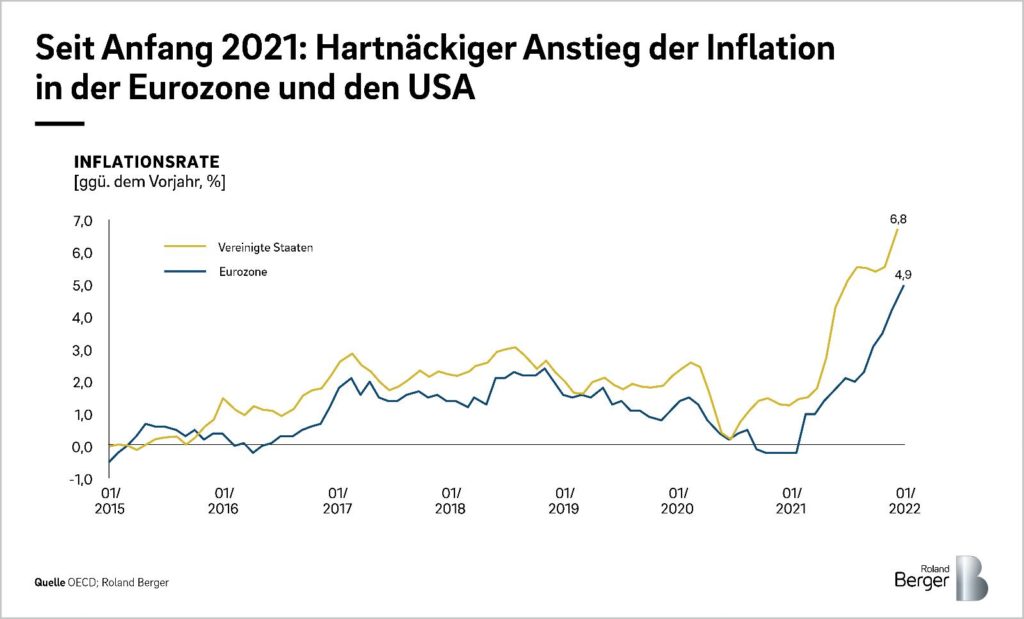

Inflation rises to levels not seen in a long time...

After many years of low inflation and low interest rates, the specter of inflation has returned:

- In the euro zone, it last rose to 4.9% in January 2022.

- In the USA it was even 7.5%.

One form of protection against a loss of purchasing power is investing in inflation-linked bonds. An inflation-linked bond, also known as an inflation-linked bond or inflation-linked bond, is usually issued by a country's government. Their cash flow is equivalent to that of a regular government bond with regular coupon payments and full repayment at maturity. In this case, however, the coupon and redemption amounts are linked to the inflation rate, which is based on an index. Most inflation-linked bonds guarantee at least 100% of principal repayment at maturity, protecting investors from prolonged periods of deflation.

Rising interest rates as a threat to inflation-linked bonds

Inflation-linked bonds are often compared to similar-maturity fixed-rate government bonds (whose coupon payments and principal do not increase due to inflation) when assessing their yield. The yield on a fixed rate government bond is called the nominal yield. This return is negatively influenced by inflation, so that the so-called real return falls - because the purchasing power of the interest coupon and that of the repayment amount has been reduced by inflation during the investment period. Inflation-linked bonds, on the other hand, are and will remain stable when adjusted for inflation, meaning that investors consistently receive consistent 'real' returns.

READ MORE IN OUR FREE BROCHURE

The Geneve Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have had corporate bonds in our portfolio for more than 20 years and why nothing will change in the future.

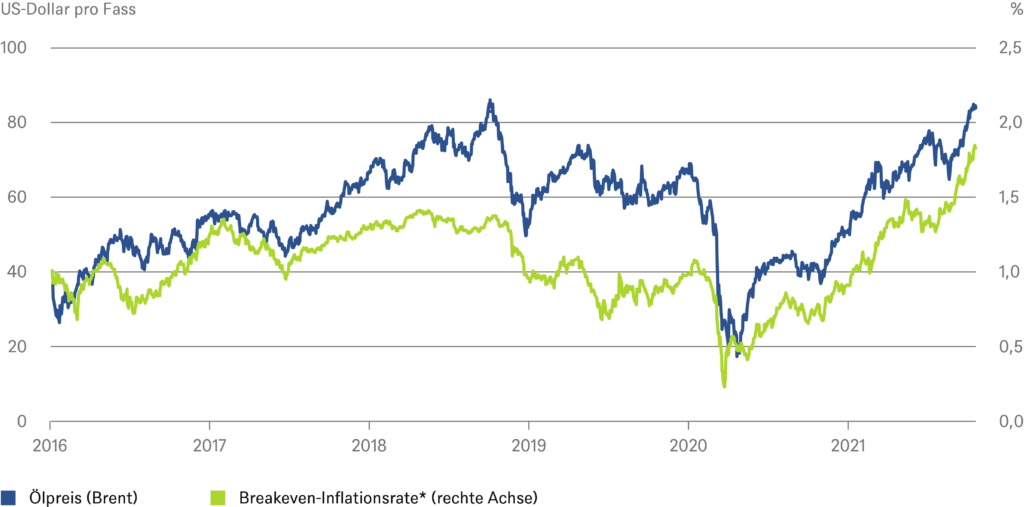

How to measure the attractiveness of an inflation-linked bond: Strong correlation with the price of oil

The difference between nominal bonds and inflation-linked bonds brings us to an important concept called the break-even inflation rate. This is the difference between the yield on a nominal fixed rate bond and the real yield on an inflation-linked bond of similar maturity and credit quality. Because inflation-indexed bonds are flexible, do not have a fixed coupon for the life of the bond, and inflation-indexing offers the opportunity for higher nominal payments, the interest rate coupon (before any adjustment based on inflation-indexing) is typically lower than for fixed-rate bonds. When inflation averages above the break-even rate, inflation-linked investing will provide better results than fixed income bonds. Conversely, when inflation is below break-even, fixed income investments will outperform inflation-linked bonds. Current 10-year government bond breakeven rates (as of March 2022):

- USA: 2,85%

- Great Britain 4.55%

- Deutschland 2,65%,

- Italy 2.47%

- Japan 0,76%

Risks of Inflation Linked Bonds

Risks to which inflation-linked bonds are exposed primarily include sovereign credit risk and interest rate risk. Sovereign risk relates to a government's unwillingness or ability to meet its borrowing obligations. Since inflation-linked bonds promise a large part of their coupon payments in later years, the average repayment is shifted even further towards the maturity date, and this results in a slightly higher credit default risk compared to regular bonds. In most industrialized countries, however, this risk is classified as low.

The interest rate risk as the most important risk

Arguably the more important risk of investing in inflation-linked bonds is interest rate risk, ie the possibility of an improvement in the interest rate environment for investors over the life of the relevant bond. Such a change would make the bond less attractive than bonds issued later and lower its price accordingly. The longer the term of a bond, the greater the change in the bond price in response to changes in the market interest rate and, accordingly, the greater the interest rate risk, a mechanism that also applies to traditional bonds.

Now is the ideal time to invest in bonds. Corporate bonds currently offer yields of over 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge and without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free advice & callback service

The Geneve Invest view on inflation-linked bonds:

Equities and corporate bonds are definitely the better alternative for private investors.

Genève Invest considers inflation-linked bonds as one of several ways to hedge a portfolio against inflation. However, inflation-protected bonds are mostly based on government bonds and therefore have very low basic yields. It's also worth noting that central banks typically raise interest rates when inflation sets in and persists. And the rise in interest rates has a negative impact on government bond prices, so that there is a risk of price losses. For the reasons mentioned, it makes sense to also think about alternatives for protecting an asset against inflation. In particular, this can be done by investing in tangible assets such as shares. However, high-interest corporate bonds (so-called high-yield bonds) also offer good protection against inflation thanks to high interest coupons.