Not a matter of course in the current low interest rate environment! For many private investors, the topic of investments and interest seems more complicated than it actually is. What is interest and where can you currently find attractive income opportunities?

Zinsen sind der Preis für das Leihen von Geld. Die Höhe der Zinsen hängt dabei vom vereinbarten Zinssatz ab. Der Zinssatz wird üblicherweise mit dem Prozentzeichen (%) dargestellt, wobei „Prozent“ „von hundert“ bzw. „Hundertstel“ bedeutet. Er gibt an, in welcher Höhe vom angelegten oder geliehenen Betrag Zinsen berechnet werden, in der Regel pro Jahr. Welche Prozentsätze werden aktuell (Stand, 2022) angeboten?

- Girokonto ca. 0% bis 0.10%, oft sogar Negativzinsen

- Sparbuch, ca. 0% bis 0.15%

- Tagesgeld, ca. 0% bis 0.20%

- Festgeld, ca. 0% bis 1.50%

- Deutsche Staatsanleihen – „Im Januar des Jahres 2022 lag die Rendite deutscher Staatsanleihen mit zehnjähriger Laufzeit bei durchschnittlich etwa -0,06 %. Verglichen mit dem Januar des Vorjahres ist dies ein Anstieg um knapp 89 Prozent. Damals wurden zehnjährige Bundesanleihen noch mit ca. -0,53 % verzinst.“ (Statista, 2022)

- Erstklassige Anleihen, erreichbare Anleihenzinsen hängen unter anderem von Laufzeit & Ausfallrisiko des Emittenten ab (ca. 0% bis 3%).

- Hochverzinsliche Unternehmensanleihen (Zinsen von ca. 4% bis 9%): Hier wird es interessant für Anleger, welche nach einer attraktiven Alternative zu Aktien suchen. Seit über 20 Jahren hat sich Genève Invest auf hochverzinsliche Unternehmensanleihen spezialisiert.

Geneve Invest focuses specifically on corporate bonds

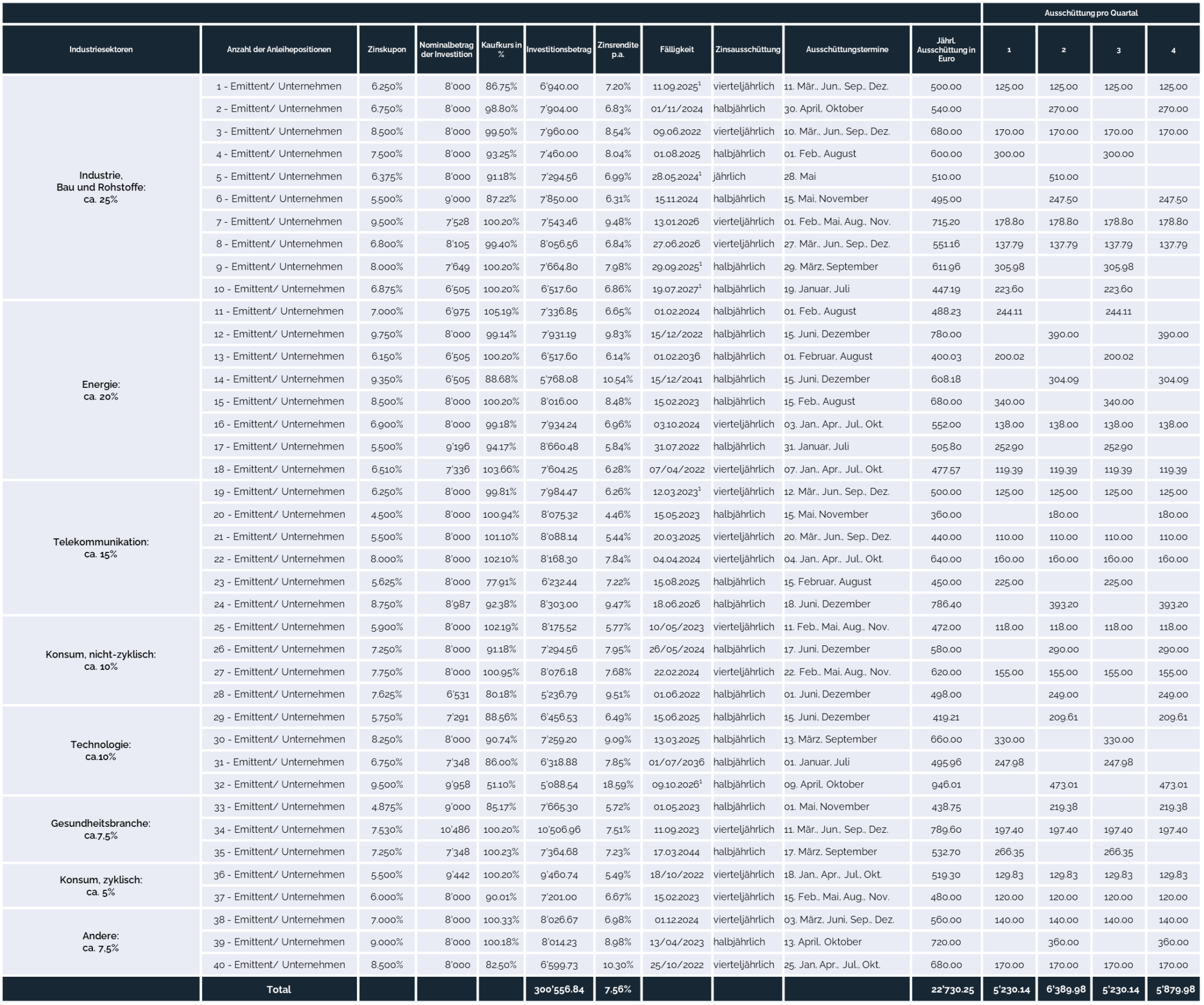

Geneve Invest specifically focuses on corporate bonds with a very good risk-return ratio. We are particularly interested in high-yield bonds from medium-sized companies in countries with an AAA rating that are active in a stable market environment. In addition, we are specifically looking for niche topics with which a return of 4 to 9% can be achieved. The niche topics include bond issues with a volume of less than 100 million euros. Corporate bonds with a yield-to-maturity below 3% are systematically reduced as the risk/reward ratio becomes negative. Below we show you a sample portfolio (exclusively corporate bonds) for an investment of around EUR 300,000. Such an interest rate calendar is always updated and made available to Genève Invest customers. The interest rate calendar serves as a guide :

- On which dates (payment dates) which interest income flows into the account;

- In addition, customers receive an overview for each quarter and for the entire year;

- In addition, each customer receives further information on the issuers, the interest yield, the investment amount, the purchase price and the maturity of each bond, among other things.

The sample portfolio shows that attractive investment opportunities can be found in this segment. A real example portfolio (with a list of bond issuers) can be sent at any time on request.

Request a real sample portfolio (interest calendar).

The Geneve Invest Group has been successful and independent in designing tailor-made investment strategies for many years. Request a real example portfolio with a detailed interest rate calendar now.

Investing and Interest: Deposit Interest & Loan Interest

The most understandable thing for everyone is the deposit rate: people save money in their bank accounts. For this, the bank can pay interest to the account holder. The interest rate applied depends on the general interest rate level and the amount of the deposit. In addition, as a rule, the longer the savers do without their money, the higher the interest rate is usually. On the other hand, if you want to buy something that you don't have enough savings for, you can borrow money, for example by taking out a loan from a bank. For this, the borrower – i.e. the one who borrows the money – has to pay interest to the bank. The amount of this so-called loan interest depends, among other things, on how creditworthy the borrower is: the higher the risk for the bank that the borrower cannot repay the loan, the higher the interest rate that the borrower has to pay. The interest rate also depends on the term of the loan. The longer the bank makes the money available, the higher the interest rate.

But there is another interest rate

But there is another interest rate that has a major impact on all other interest rates: the base rate. When banks need money, they ultimately have to borrow it from the central bank. They have to pay interest for that. The amount of this interest as a percentage of the borrowed amount is the prime rate. In the euro area, it is set by the Council of the European Central Bank, which in turn aims to keep the purchasing power of money stable.

Development of the interest rate of the European Central Bank for the main refinancing operation from 2008 to 2022

Numbers in percent. Status: February 2022

The key interest rate influences all other interest rates in an economy and thus also influences the entire economic life: if the central bank increases the key interest rate, the commercial banks also increase the interest rates for their customers. This makes credit more expensive for customers, and saving more worthwhile. Demand in the economy tends to fall and, as a result, so does the rise in prices. Conversely, falling interest rates stimulate demand for credit and make saving less attractive. Demand in the economy increases, and as a result, prices also tend to rise faster. The indicator for the development of prices is the inflation rate. This is important in connection with two other interest rate concepts: the nominal and the real interest rate. The interest rates quoted are referred to as nominal interest rates. If one subtracts the inflation rate from these, one speaks of real interest rates. So interest is not the same as interest. Savers enjoy high-interest rates. Borrowers, on the other hand, are happy when their interest rates are as low as possible. And everyone – banks, companies, consumers, and the state – is watching interest rates as an important signal for the economy.

Now is the ideal time to invest in bonds. Corporate bonds currently offer yields of over 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge and without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free advice & callback service

For you as an interested investor who is looking for attractive interest rates when investing, the following applies:

Low interest rate environment + high inflation + traditional savings = loss of purchasing power!

Conclusion: You must invest your money strategically! Corporate bonds & shares can offer you attractive interest rates & yields.

Conclusion: Find out about attractive investments and interest rates.

T he interest rate largely determines the return on an investment. In principle, the higher the interest rate on an investment, the higher the return. The same applies, of course, to the reverse case. When investing in a savings account, in a fixed or time deposit, the connection between interest and return is easy to understand. The interaction of interest and yield becomes somewhat more complex when an investment is made in a fixed-interest security, a bond. Because in addition to the pure interest rate, the following also play a role:

- The term (or remaining term),

- as well as the price development of the bond play a role in determining the yield.

- The frequency of the interest coupon, ie the interest payments, also influences the return on the investment.