Real estate as an investment: self-use or better rent?

In times of extremely low or even negative interest rates, the idea of investing one’s savings in real estate is an obvious one. Basically, one should distinguish between two cases: the investment in an owner-occupied residential property and the investment in an investment property used by third parties.

The former makes perfect sense in order to achieve a certain degree of financial independence and to be able to fulfill one’s individual wishes and ideas when it comes to living. In the following, we would like to take a closer look at the second case: a property used by third parties as a financial investment in order to generate a return. Real estate returns must also always be viewed against the backdrop of investment alternatives as well as the respective financing options.

The Corona crisis has continued to drive the real estate markets

But what to do when the interest rate turnaround is just around the corner?

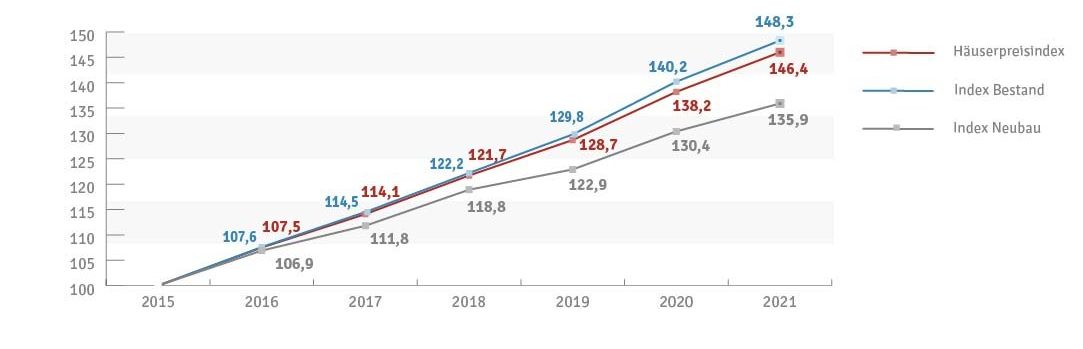

In the current extremely low interest rate phase, more and more people are considering real estate as an attractive capital investment. Houses and apartments are not only considered to retain their value, but also promise considerable returns. Project developers and brokers regularly quote a range of 4 to 6 percent per year. Due to falling interest rates, the prices of real estate have been rising steadily for many years. Rent levels also continue to reach new heights with a certain lag. Especially in sought-after locations and the country’s metropolises such as Berlin, Hamburg, Frankfurt and Munich, rents and real estate prices continue to set new records.

Anyone interested in real estate as an investment often receives a model calculation or at least an indication of the expected return from the sellers and project developers. It is not uncommon for the promised returns on real estate investment to be between 4 and 6 percent per year. These often overly optimistic forecasts by real estate sellers come true especially if the property value and rent increase significantly by the time of sale and maintenance expenses remain low. However, these assumptions are often very optimistic, especially in the event that interest rates start to rise again from the low interest rate environment.

What factors are important for real estate as an investment? The following is a list of the key points that determine the success of a real estate investment.

The most important criteria for real estate as an investment

What should definitely be considered in real estate investment, step by step:

- Purchase price:

How high is the purchase price of the property in relation to the achievable annual cold rent? Is this a common ratio for the location? A property that costs less than twenty times the annual cold rent can be considered inexpensive. A factor of 25 is often common. In many sought-after locations, however, prices of 30 times and more are often encountered, which can be considered expensive.

- Incidental costs of acquisition:

How much are land transfer tax, notary fees and broker commission for the property? Often, the additional costs amount to another 10 or more percent of the pure purchase price.

- Service life:

On what period should the investment be calculated? The longer, the more advantageous. What are the expectations for how the real estate location might develop? When and how should the investment be completed?

- Rental income:

What cold rent per square meter can be expected? Is this rent achievable in the location for comparable properties? Who takes care of re-leasing when tenants quit and the property is vacant?

- Administrative costs:

What are the management costs for the property? What should be the scope of the mandate for the property manager?

- Maintenance expense:

What is the foreseeable community maintenance expense? How much is the house money for this? In addition, what amount should be set aside for repairs and modernization of the property?

- Taxes:

What is the division of land and building for tax purposes? How much is the depreciation then? What is the marginal tax rate of the respective investor?

- Funding:

How do the fixed interest rates for the planned financing and the useful life of the property relate? Will follow-up financing be required after the fixed-interest period expires? How will interest rates develop over this period? What does a calculation and forecast of rents and thus returns look like when interest rates rise?

- Resale:

What factors are already influencing the development of property values today? Are there foreseeable risks? Is it realistic to be able to resell the property at the same multiple (ratio of annual rent to purchase price) as it was purchased?

Independence and freedom through owner-occupied real estate as a financial investment

These basic considerations of return on investment are the same for all properties offered, whether it is an ordinary condominium for rent, a vacation home, apartments in a retirement community or student housing, or an entire apartment building.

From the point of view of an asset manager who has insight into the asset situation of many clients, it can be stated that an owner-occupied residential property naturally makes a lot of sense. Being able to live rent-free and debt-free in retirement guarantees a high degree of freedom and extensive independence.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% p.a.

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

The income property should be a hit and also fit into the investor’s overall portfolio context!

D

he benefit of a property used by a third party, i.e. rented out, is somewhat more complicated to assess. A property in a desirable and up-and-coming location with rising rents and increasing sales prices may well be a lucrative investment alternative. However, one should be very aware of the high effort, the risks and the difficulty and tediousness of selling the property again.

Real estate investments are therefore very long-term and also cumbersome, often tying up a large part of a private investor’s capital.

It is important to compare the characteristics of real estate investment with the respective advantages and disadvantages of other alternative asset classes and to tailor them to one’s own circumstances and needs. An experienced asset manager can provide a lot of helpful advice in this regard.

The advantages of flexible investment in securities are discussed in detail in the brochure below.