Retirement provision and taxes: This is how pension taxation works

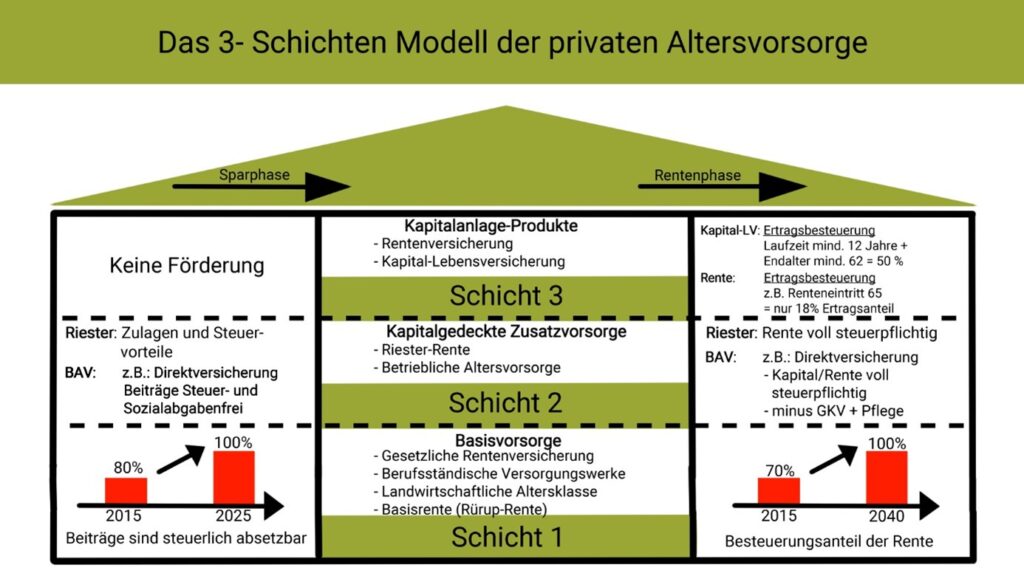

State-subsidized old-age provision works according to the principle of deferred taxation. How old-age, Riester and company pensions are taxed.

How can you save taxes with retirement planning?

Contributions to the so-called basic supply are tax-deductible up to a maximum amount as special expenses. These include:

- Contributions to the statutory pension insurance

- Rürup pensions

- Professional pension schemes (for the self-employed)

- Agricultural retirement funds

- 724 euros for singles and

- 448 euros for married couples.

READ MORE IN OUR FREE BROCHURE

The Geneve Invest Group has been successfully active in the field of asset management for many years and offers you valuable insights into the capital market. Find out why we have had corporate bonds in our portfolio for more than 20 years and why nothing will change in the future.

Claim the pension expense

There is a separate form in the tax return for the contributions to old-age provision, the attachment “Precautionary Expenses”. Taxpayers can also claim their other pension expenses here, for example for:

- Employment and Disability Policies

- Accident, liability and term life insurance

- Annuity and capital life insurance (old contracts before 2005)

- Contributions to pension and capital life insurance from 2005

- Building savings contract costs

- Contributions to a direct insurance or pension fund (if they are tax-deductible)

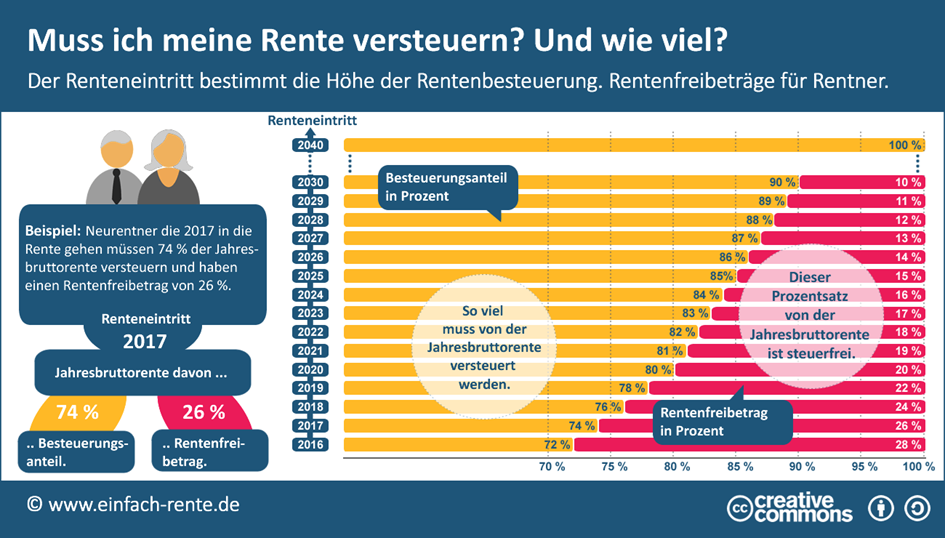

Subsequent taxation

Just like salary from working life or income from self-employment, taxes are also due for pensions (and also for other old-age benefits). However, pensions will not be taxed 100 percent until 2040. Until then, the portion of the pension from which taxes are deducted increases gradually.

The principle of deferred taxation applies here: Although pensions are taxed, the contributions to basic old-age provision are tax-free up to a maximum amount for employed persons. This applies not only to payments from statutory pension insurance, but also to:

- Pensions from professional pension institutions

- Payments from a private funded annuity insurance (Rürup pension)

Now is the ideal time to invest in bonds. Corporate bonds currently offer yields of over 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge and without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free advice & callback service

What about downstream taxation in 2022?

Anyone who retires in 2022 and draws pensions from a basic pension for the first time must pay tax on 82% of this. For each new generation of pensioners, the share of taxation increases by one percentage point until 100% of pensions are taxed from 2040 onwards. How much of the pension is taxed is fixed for each pensioner individually until the end of their lives - in the form of a tax-free allowance in euros and cents. For pensions that started before 2006, the tax rate is 50%. The gross pension is considered a pension in the sense of the tax office; i.e. before deducting the personal contribution to health and long-term care insurance. Riester pension, company pension and other pensions:

- Riester pensions and company pensions are fully taxable.

- Disability pensions and widower/widow pensions are taxed retrospectively.

- Payments from statutory accident insurance

- War and severely disabled pensions

- indemnity pensions

- Basic security according to the Social Security Code (SGB XII)

Do all pensioners have to pay taxes?

It is true that pensions are taxable under the tax regulations now in force; But that doesn't mean that every retiree has to pay taxes. As a retiree, like any other taxpayer, you can deduct a number of things from your income: first of all, a basic allowance that applies to all taxpayers. In 2021, this exemption amounted to 9,744 euros, in 2022 it increased to 9,984 euros.

Anyone who exceeds these allowances must submit a tax return. Whether a pensioner will have to pay taxes in the future also depends on what other income he still has. Because some retirees have income from a condominium, a private pension product or interest income in addition to the payments from the statutory pension insurance.

OTHER PITCHES IN PENSION PROVISION

You can find out what other pitfalls can be lurking in addition to taxation in old-age provision in our brochure: "8 avoidable mistakes in old-age provision", which you can download HERE: