There is no question that there is a lot going on on our planet at the moment: an escalating conflict between the major powers USA and China, the increasingly noticeable climate change, the refugee problem that keeps flaring up, the aftermath of Brexit, disrupted supply chains worldwide, the fifth wave of the The corona pandemic and, of course, the war that recently broke out in Ukraine with all its effects make people clearly feel that we live in uncertain times. Is there still a safe investment in the crisis?

The prices of many important raw materials and goods are going crazy, and the markets are experiencing severe turbulence. The future has seldom been more uncertain than today! In such uncertain times, the desire to make a safe investment grows all the more. It is not for nothing that the demand for fixed-income investment strategies has increased enormously in recent years.

Learn more about fixed income investments

Geneve Invest is an asset management company with more than 20 years of experience and over 1,000 clients. Thanks to these decades of experience, we are able to give you, as a private investor, valuable first-hand insights into the area of profitable asset management.

What is a safe investment anyway?

There are several forms of security in an investment:

- The security of regularly receiving a predictable interest coupon.

- The certainty of getting the full amount back at a previously defined point in time.

- The security of being able to liquidate or sell the investment before it is due.

- The security of not being subject to price fluctuations. Of course, a combination of these different types of security would be the best solution for an investment. Unfortunately, there is no such thing as absolute security in this world. We're all still looking for it: the jack of all trades!

Of course, a combination of these different securities would be the best solution for an investment. Unfortunately, there is no such thing as absolute security in this world. We're all still looking for it: the jack of all trades!

Don't forget: Security often costs a lot of money

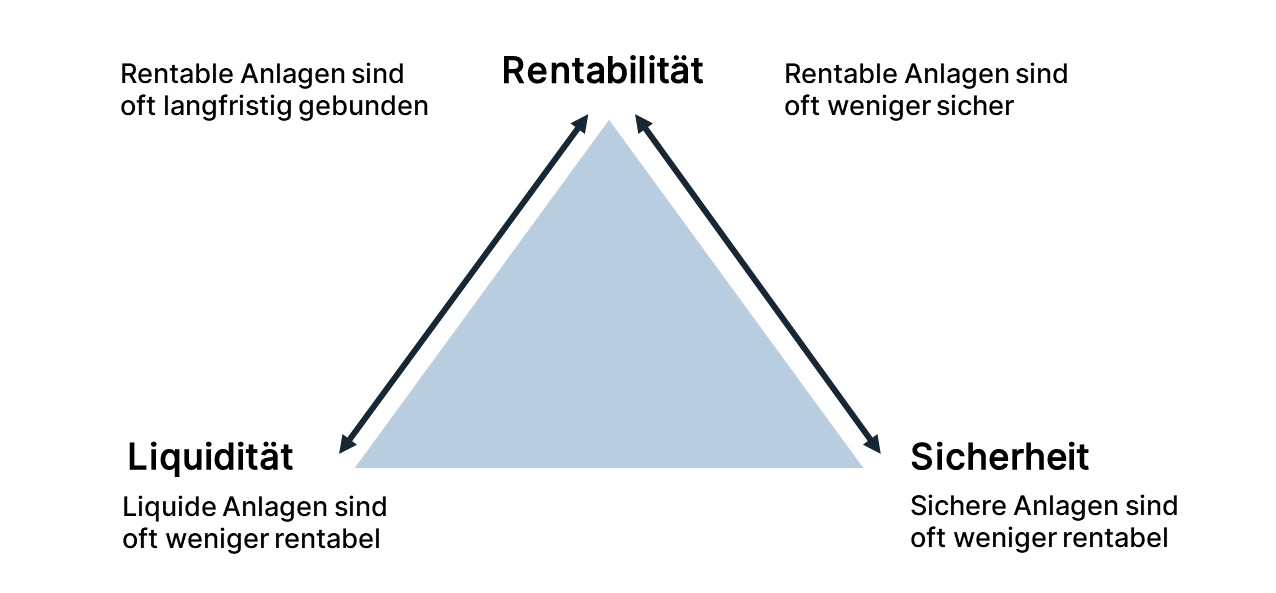

Any security comes with a cost. Costs that often translate into reduced returns. Basically, when it comes to investing, security and returns are opposites. This means that the higher the security of an investment should be, the lower the return is usually. The same also applies to the reverse case. So we will have to do without returns for a safe investment. This is evident in the well-known magic triangle of investing

There is usually only "penalty interest" as a reward for saving

In the current environment of extremely low interest rates, investing as securely as possible means forgoing any interest or even having to accept negative interest. Many banks and savings banks are already charging so-called "penalty interest" on high cash holdings of more than 50,000 or 100,000 euros. The saver pays for the fact that he can deposit his money at the bank.

The paradox of negative interest: savers and investors give money to the state

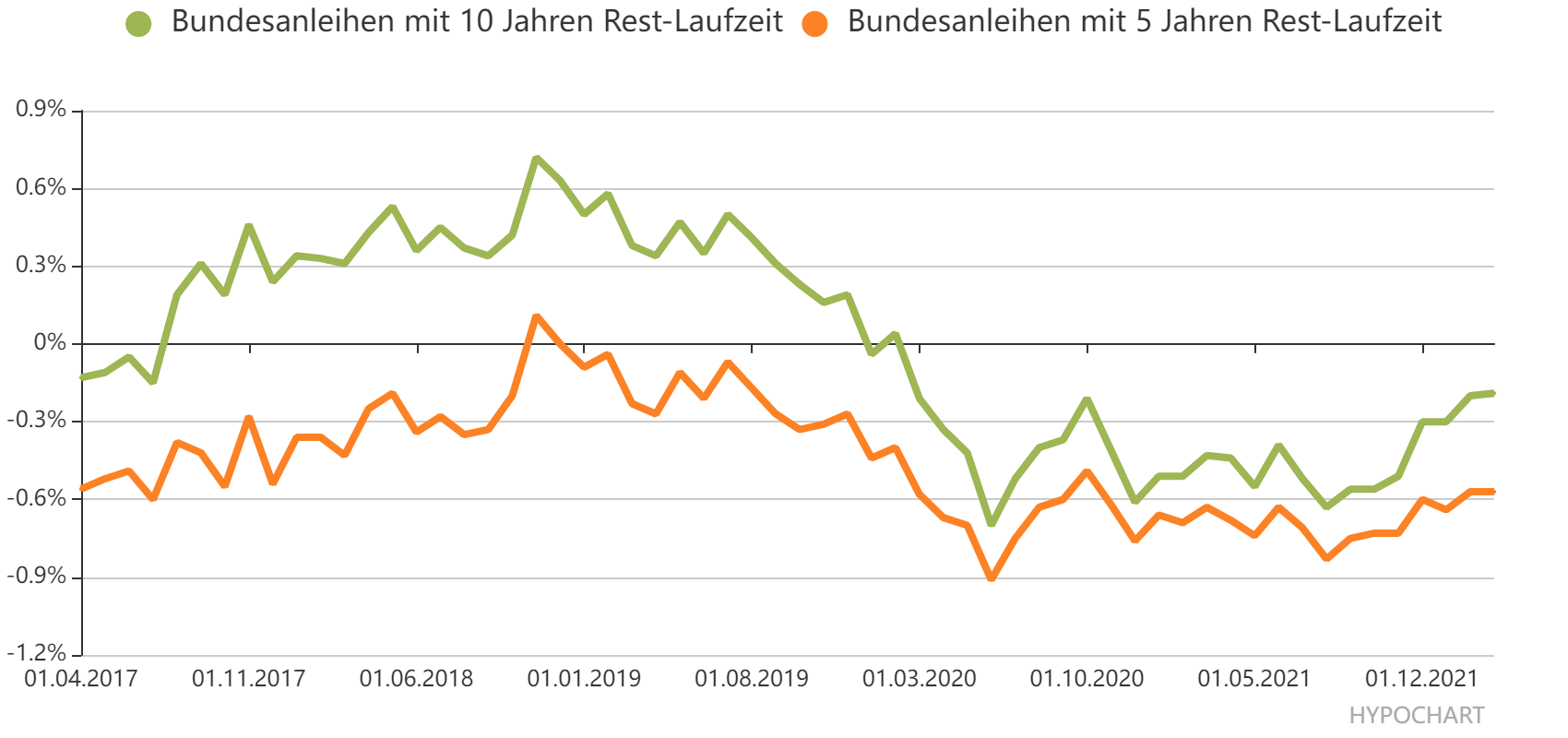

The 10-year federal bond is currently yielding around -0.3% (as of January 2022), as can be seen from the graphic below (source: Hypochart ). This means that when you buy this bond, you consciously accept that you will get less money back on maturity than you originally invested, despite the interest coupons! So you give the state money and pay them to keep the money safe. A paradox.

- 10-year Bund at -0.3% as of January 2022

- Inflation rate: 5% as of January 2022

- Annual purchasing power loss 5.3% 2022

Added to this is the inflation rate, which has risen to 5%, which makes an investment in federal securities even more negative. According to the current status (January 2022), the highest security level of the financial investment costs 5.3% per year. This can no longer be described as an investment, but rather as a conscious divestment. Money destruction par excellence just to be as safe as possible? Makes no sense!

Now is the ideal time to invest in bonds. Corporate bonds currently offer yields of over 7% P.A

Arrange a callback from one of our experts now. We advise you free of charge and without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free advice & callback service

So do we have to sacrifice security?

You will certainly have to do without 100% security if at least a certain return is desired. If you replace the highest credit rating in the Federal Republic of Germany with the lower credit rating of a company such as Volkswagen, a return of around 3% can be achieved. For small and medium-sized companies with a lower credit rating, 5% or 6% are also possible. Expertise is required here! With strategic long-term goals, the investor can have an enormous influence on the security of the investment made. In addition to a sufficient investment horizon and the selection of fundamentally strong companies, this also includes effective diversification.

So what matters in uncertain times?

Effective diversification is what counts: Money should be invested strategically and effectively for the long term!

Above all, it is important to spread the credit risk across several companies from different sectors and countries. As a private investor, you can control the credit risk yourself to a certain extent (this applies in particular to corporate bonds). The investor should also focus on different asset classes (equities, bonds, alternative investments) that offer effective diversification and therefore do not correlate too strongly with one another. It is therefore important to strive for a strategic investment. Even and especially in uncertain times like these. But even after the investment has been made, all companies must continue to be observed and analyzed in order to intervene if necessary. This can be tedious and expensive. But:

THE EXPERT CAN HELP

The strategic investment requires a certain understanding of economic relationships as well as knowledge of company key figures and also means a higher expenditure of time. Those who shy away from this can seek advice and support from an experienced asset manager. And so, even in these uncertain times, it is still possible to make a safe investment that also earns you money. Geneve Invest offers you non-binding advice on: SECURE INVESTMENT IN UNCERTAIN TIMES