Time deposits and their maturities

F

est funds and their maturities differ relatively frequently from other financial investments. Time deposits with maturities of 1 month, 3, 6 and 12 months or 2, 3 and 5 years are particularly common.

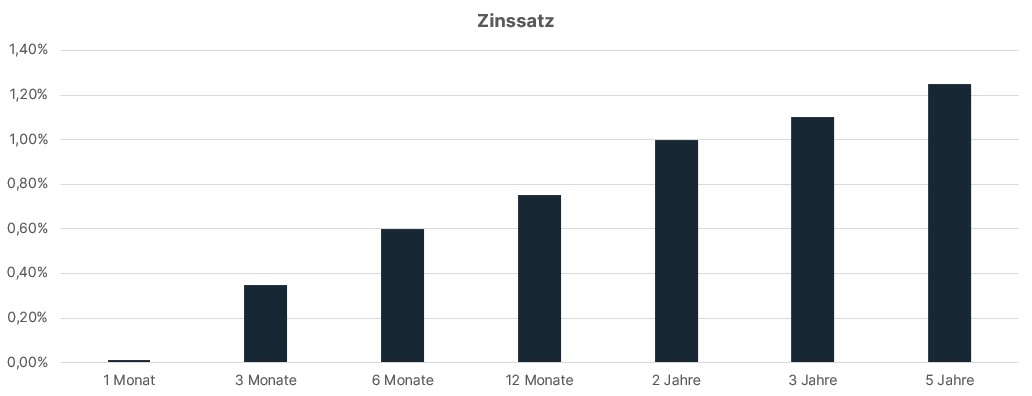

In normal interest rate periods, the rule of thumb is that the longer the fixed term, the higher the interest rate. Currently (as of January 2022), various comparison portals for fixed-term deposits show the highest interest rates (each p.a.) for the following maturities:

1 month: up to 0.01%

3 months: up to 0.35

6 months: up to 0.60%

12 months: up to 0.75%

2 years: up to 1.00

3 years: 1.1%

5 years: 1.25%

All in all, these are not really attractive interest rates, some of which are well below the rate of inflation .

Optimal design of time deposits and maturities

U

n order to control liquidity with fixed-term deposits, it makes sense to spread larger fixed-term deposit amounts over different maturities. For example, a fixed deposit of 100,000 euros can be split into 30,000 euros for a term of one month, 30,000 euros for 6 months and 40,000 euros for 12 months. This form of investment is also known as the “interest rate staircase”. This means that, on the one hand, the investor receives slightly higher interest, but on the other hand also remains liquid on a monthly basis. Another advantage is that the investor can react flexibly to any changes in interest rates. This strategy makes all the more sense if a general rise in interest rates is expected. As could happen this year if the European Central Bank actually raises interest rates again after many years of rate cuts.

For higher amounts, it seems advisable to compare offers from different providers with different terms. There are numerous platforms on the Internet that compare and evaluate various fixed-term deposit offers. These comparison platforms include such well-known names as Check24, Finanztip, Verivox, Focus and, of course, Stiftung Warentest, which enjoys a particularly high reputation among consumers.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% p.a.

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

Our recommendation on time deposits

A

s an investor looking to invest larger sums over different maturities, you should also consider investing in corporate bonds. This is because bonds offer some distinct advantages over investing in time deposits. Bonds accumulate interest daily, similar to overnight money. This so-called accrued interest is also paid out if the bond is sold early. This brings us to the second advantage of bonds: they are usually listed on the stock exchange and can be bought and sold daily at the current price. The third and decisive advantage of bonds is that they usually offer a higher interest rate than fixed-term deposits with a comparable maturity. Corporate bonds with the best credit rating, for example, can yield 1-2% per year.

Yields of 5-6% or more are also possible for corporate bonds issued by smaller companies and in niche segments. In this area, however, it is important to balance the risk well and to develop a precise understanding of the business model of the respective company. This is hardly possible for the private investor in individual cases due to the complexity of the matter. Here, an experienced asset manager who has been intensively involved in the area of high-yield corporate bonds of different maturities for years can be a good support. Genéve Invest is a specialist in evaluating and assessing the opportunities and risks of high-yield corporate bonds on the European and American markets, also in various foreign currencies. A competent Genéve Invest advisor will be happy to share this experience with you at any time.