What is the best investment?

He quality of an investment depends very much on an investor's individual ideas. A good investment for one represents an investment that yields regular and calculable returns. For the other, it is a good investment if he knows when the investment will mature again. The next person, on the other hand, likes it when an investment yields a high return. And for someone else again, it is good if an investment is not subject to any price fluctuations. However, it is still possible to concretely define the best investment.

How do I measure a good investment?

Like can I find a good investment? And for whom is an investment actually good? A good investment always springs from a certain combination of return and security. If security is the greater motivation, then an investor should look for a fairly short-term maturity of the investment as well as expect precisely predictable interest payments. Here, the savings account, a time deposit or government bonds would be the best investment. Of course, with such investments, considerable losses have to be accepted in terms of returns. Strictly speaking, these above-mentioned forms of investment yield close to zero or are even negative.

On the other hand, there are investors who are prepared to accept more risk in return for higher returns. The distributions are subject to fluctuations and are not exactly predictable. The maturity of the investment is far away or not fixed at all. In addition, the investment is subject to price fluctuations. However, investors are rewarded for this sacrifice of security in their investment with a correspondingly higher return. For equity investments, the long-term average return can be 7-10% per year (depending on the calculation method). Most investors feel several of the above needs within themselves. Of course, every investor wants to achieve a high return on investment, but at the same time wants to know that his investment is safe. Therefore, it makes perfect sense to think about a combination. In other words, a combination of many different financial investments in securities.

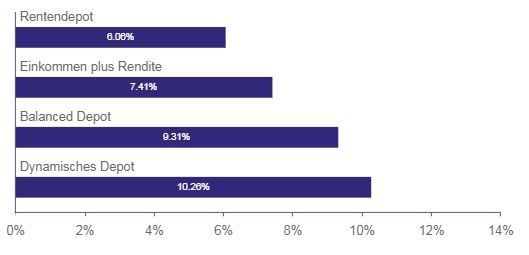

In line with Genève Invest's many years of experience, a broadly diversified portfolio of corporate bonds and equities has proven to be a good investment for private investors. Because this portfolio meets many investor needs. Corporate bonds have predefined maturities. The interest coupons of fixed-income securities are usually fixed in advance and their payment dates are known. The cash flow is therefore calculable. The return of this overall portfolio is then provided by the shares of value companies, which can of course be subject to higher price fluctuations, but which contribute 7-10% to performance over the long term.

Now is the ideal window of opportunity to invest in bonds. Corporate bonds currently offer yields in excess of 7% p.a.

Arrange a callback from one of our experts now. We advise you free of charge & without obligation and find the best corporate bonds for you.

For investors with €100,000 or more

Free consultation & callback service

Balanced portfolio as the best investment

A portfolio with a balanced investment strategy consists of around 50% corporate bonds and 50% equities. The equity quota can also fluctuate within a range of 40-70% depending on the market situation and individual investor preference. Genève Invest's long experience has shown that this balanced portfolio is preferred by most clients. So, in the eyes of investment experts, it is the best investment for most retail customers.